Since December 2019, COVID-19 pandemic has brought a dramatic change of demand in terms of volume and value to every industry including the aviation industry. Despite the significant drop of air travel in 2020 due to the pandemic, the aviation industry is slowly recovering. The air traffic is expected to return to that of 2019 levels in 2023 for domestic traffic and in 2024 for international traffic and will continue to grow. This growing traffic brings business opportunities, not only to the airlines and airports, but also to other related businesses particularly for Maintenance, Repair and Overhaul (MRO).

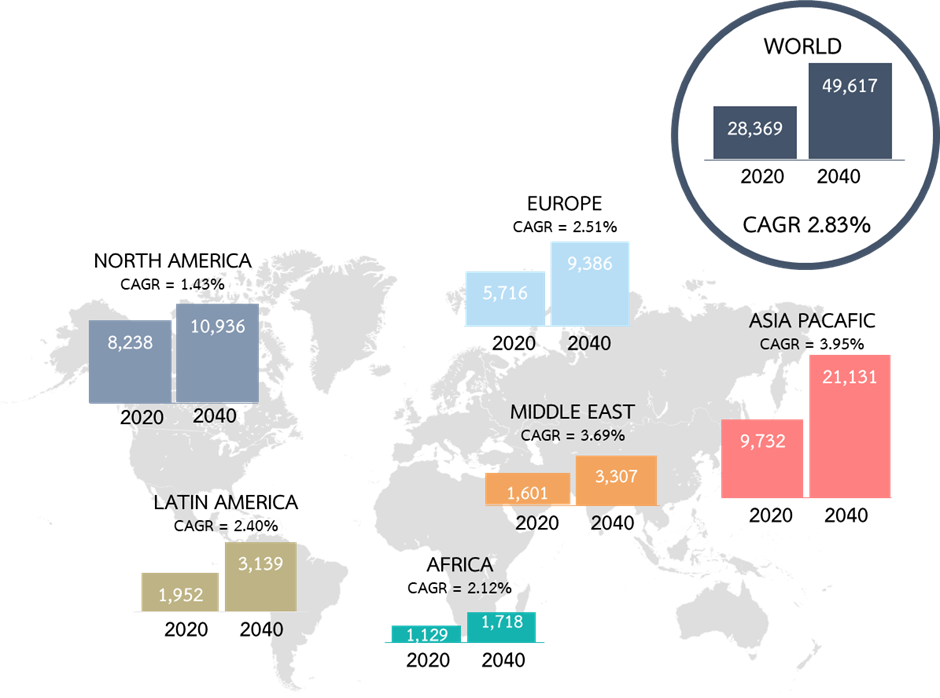

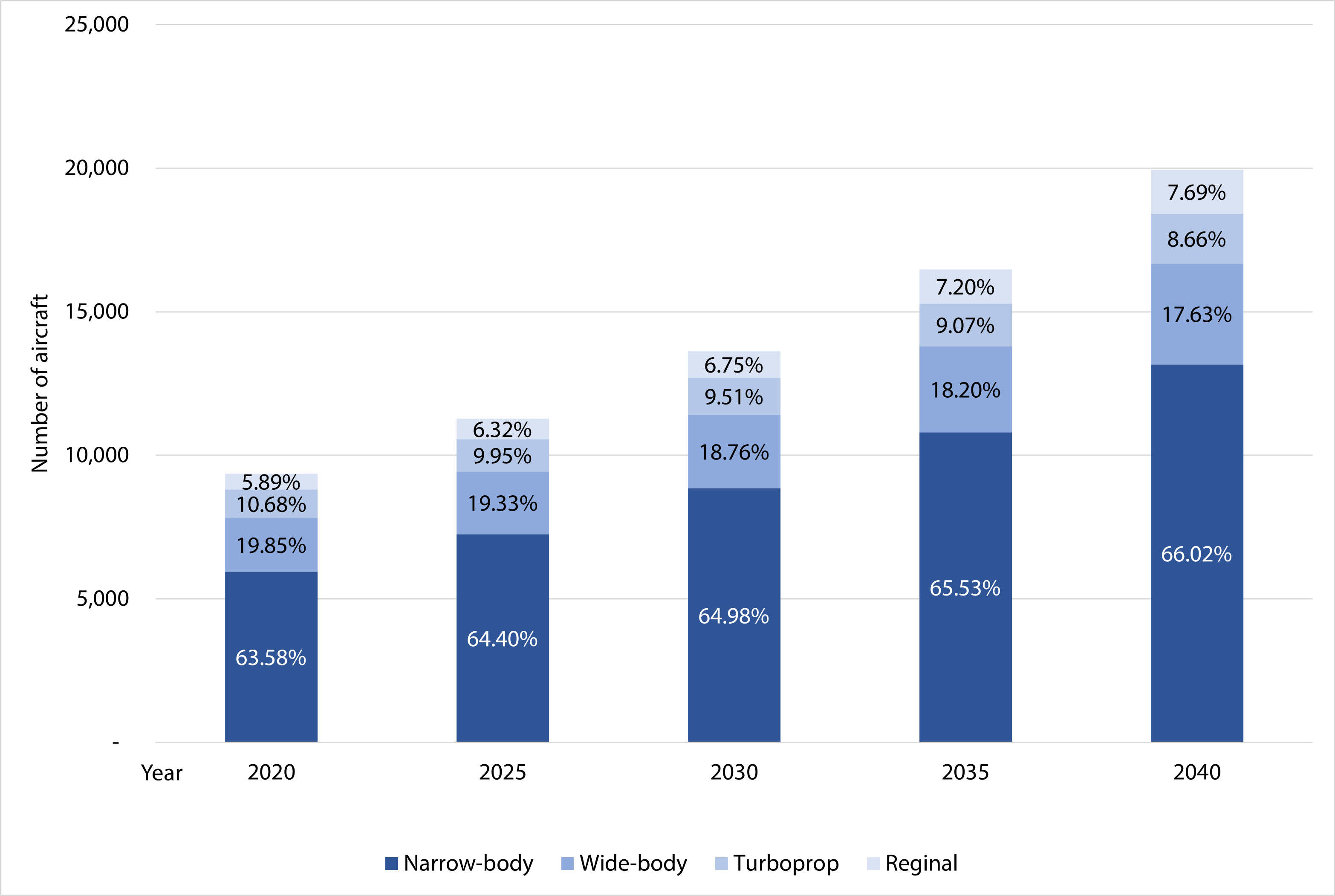

Aircraft maintenance is important for the airline to minimize the costs without compromising safety and airworthiness. The airlines intend to expand their aircraft fleets to serve the growing demand of air travel and to replace the old aircrafts. This expansion contributes to the rising demand of aircraft maintenance. The world aircraft fleet is projected to reach 49,617 aircraft with the Compound Annual Growth Rate (CAGR) of 2.83% from 2020 to 2040. Asia Pacific is forecasted to have the highest aircraft numbers with the CAGR of 3.95% as shown in Figure 1 (Boeing, 2022). In addition, narrow-body aircrafts have the highest share comparing to other aircraft types in 2020 and continues to gain share of 66.02% in 2040 as shown in Figure 2 (Boeing, 2022). This trend would be resulted from the growth of low-cost airlines and increase of middle-class income population which tend to travel more often in the short period of time.

Interestingly, Thailand, as located in Asia Pacific, shares the same trend of aircraft expansion especially for narrow-body aircrafts which are mostly operated by low-cost airlines. This is an opportunity for investors to expand or invest in MRO business.

Currently, MRO industry in Thailand is in the early stages of development in order to serve the increasing demand for aircraft maintenance. Nearly 60% of aircraft maintenance spending has been benefited to foreign MRO service providers (CAAT, 2018). This emphasises that there is the opportunity to enhance MRO business to serve the local demand currently exported and to capture the demand from neighboring countries. Therefore, Thailand must hasten the development of MRO industry in order to serve the local demand currently exported and to compete with ASEAN member countries such as Singapore and Malaysia which are the major players in the market. Along with promoting the ecosystem of the aviation industry, which is considered as one of the targeted Thailand’s S-curve industries.

From a glance, Thailand has the potential to enhance the MRO business. One of the key drivers is the infrastructure and facilities of 35 airports which have the capacity to operate all types of aircraft and serve commercial air services. Importantly, availability of airport land would be seen as the enabling factor to set up and promote the ecosystem of MRO business covering airframe, engine and component maintenance. Moreover, inter-transport modal connectivity to airport can benefit to transport aircraft parts with controllable logistics costs and time.

Thai government also strongly expresses the commitment by incorporating the aviation sector into the list of targeted Thailand’s S-curve industries which will be supported by infrastructure development and incentives for investors.

This should be convincing enough for operators and investors to enter Thailand’s market. From the supply side, there are also a number of investors expressing interest to establish aviation maintenance bases in Thailand. However, to become more successful in the MRO industry, Thailand can support more in many aspects.

Firstly, the commitment from the government should be enriched by initiatives and pilot projects to show that the published MRO roadmap is realistic and executable. The roadmap should specifically determine the type of business and implementation timeline of each type. With those in place, the investor then can assess whether they are fit with the future of Thailand’s MRO industry that the government expect and have clear instruction on how to take part.

Secondly, the ease of doing business in Thailand for foreign companies is important. Regulations related to business equity ownership, foreign employment, and customs should be simplified to attract foreign direct investment with less impacts to local business.

Thirdly, the incentive packages should be tailored to the needs of MRO in such a way that they are more attractive to the investors than the packages that are available in the market.

Lastly, qualified workforces are needed. Training centers/schools should be promoted in order to produce the qualified workforce to serve the MRO industry in a timely manner.

Enabled by lower minimum wage and on-going infrastructure investment such as high-speed rail, deep seaports, and airport development projects, Thailand is still being competitive in this industry. To unleash the potential of Thai MRO business, close collaboration between public and private sectors must be nurtured since the solution to overcome the challenges required contribution from all parties. Eventually, the demand for maintenance services that were once served by other countries will return to Thailand, which will bring, not only the success to MRO businesses, but also generate revenue to local ecosystem and strengthen the position of Thailand as a center of MRO in ASEAN.

Authors:

Joined to70 as an aviation consultant for over 4 years since graduating with BSc in Aerospace Engineering from Chulalongkorn University, Thailand. In charge of managing projects in aviation maintenance, and aviation related software implementation.

Joined to70 as an aviation consultant for over 7 years since graduating with BSc in Aviation Technology Management from Kasetsart University, Thailand. In charge of managing projects in aviation strategy, aviation safety and aviation related software implementation.