On the rise: Aviation’s Non-CO2 emissions

Except for a handful of aviation academics and experts looking into the climate warming impact of non-CO2 emissions, the topic was largely avoided in the past decades. Now the issue is on the rise, and it is time to inform the sector.

The rise of Non-CO2 emissions

In 2020, EASA kicked off the debate into non-CO2 in aviation by publishing “Updated analysis of the non-CO2 climate impacts of aviation and potential policy measures pursuant to EU Emissions Trading System Directive Article 30(4)[1]”. This sector report followed many years of research on non-CO2 emissions in aviation, describing the radiative forcing (ergo climate warming) impact of non-CO2, contrail modeling and warming impact assessment. The academic and EASA results show non-CO2 emissions warming impact may be equal to or even twice as high as CO2 emissions.

In recent years, several EU research projects as well as contrail trials were set up by flight planner Flightkeys and network manager EUROCONTROL. Most recently, the topic has been picked up by EU legislators in the form of a heavily debated (and lobbied [2]) Monitoring, Reporting and Verification (MRV) framework. In the meantime, the academic front continued their research. Under leadership of the DLR, Imperial College, MIT and others, progress is being made on atmospheric physics that explains where contrails form, prediction; and mitigation strategies. Google Research is including satellite imagery data to further improve the models. (figure 1). Finally, Breakthrough Energy’s Reviate team is specializing in predicting contrail formation and has developed an interface to allow airlines to build contrail avoidance into their flight planning.

Figure 1: Reviate Contrails map

Considering the recent action and new insights around the topic, many aviation stakeholders are likely (and rightly) wondering: “Is this relevant for me and if so, why?”. To answer that question, let’s first dive into what non-CO2 emissions are.

Contrail formation

The main non-CO2 emissions from aviation in terms of climate warming impact, are nitrogen oxide (NOx) emissions, water vapor emissions, but above all formation of persistent contrails that contribute at least 86% of the total non-CO2 emissions in aviation. Contrails are cirrus clouds that form as a result of aircraft engine soot particle and water vapor emissions reacting with the water vapor in the atmosphere. These clouds can have both a cooling effect by reflecting sunlight, and a warming effect when they block heat radiating off the earth. The total warming effect is larger than the cooling effect. This leads to a net warming effect.

Figure 2: Contrail impact (Reviate)

Globally, only around 5% of all flights form over 80% of the warming contrails. Adjusting a small portion of flight operations could lead to a considerable reduction of warming impact. There are two main methods being advanced to reduce (warming) contrail formation. First is the use of alternative fuels that produce less soot and thereby less contrails, though the effect of this seems limited with current SAF targets [3]. The second method is the avoidance of contrails by adaptation of the flight path to avoid atmospheric areas that are prone to contrails (so called “ice super saturated regions”). This way, contrails are not formed regardless of the engine emissions. At To70 we have teamed up with Breakthrough Energy and several airlines and flight planners to work on contrail avoidance in the EU innovation fund application “Contrail Pilots”.

Airports

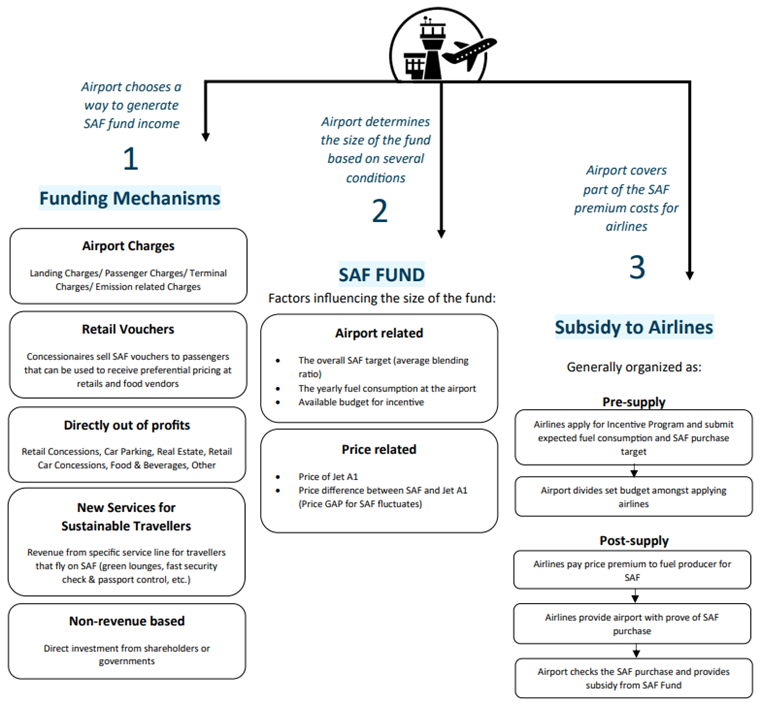

Although airports do not seem to have a significant role (yet), they are interested in the topic. For airports, non-CO2 emissions historically focus on local emissions (Particulate matter, nitrogen oxides) emitted during taxi, takeoff and landing. In a project To70 did for the Roundtable on sustainable biomaterials (RSB), we assessed the role of airports in reducing aviation non-CO2 emissions to improve local air quality and to reduce contrail formation. The key takeaways presented to RSB focused on (1) stakeholder engagement to increase the use of targeted SAFs, (2) identifying opportunities for optimal SAF supply chains and (3) the development of market shaping strategies that incentivize the use of SAF to reduce non-CO2 emissions. In terms of flight path or airspace changes, airports do not have a significant role as of yet though these are being explored.

Air Navigation Service Providers

At first glance, ANSPs would seem to be the most impacted by non-CO2 emission mitigation strategies that involve adjusting the flight’s route and profile, as they govern airspace. They should be well informed on the topic and have a clear grasp of potential changes. However, recent developments and trials by flight planners show that pre-tactically changing flight plans to avoid ISSRs may be sufficient to reduce contrail formation. The ANSP or network manager would see incidental but high impact flight plan adaptations due to contrails mitigation but would not have to adapt their own systems. On the other hand, EUROCONTROL has run initial trials to reduce contrail formation through tactical adjustments of flights within the airspace rather than by the flight planner on the ground.

These strategies for airports, ANSPs and other aviation stakeholders are currently being further developed and tested. At To70, we see the need to inform stakeholders and support them in taking action to reduce non-CO2 emissions. Beyond our support to the EU MRV and airport non-CO2 insights, To70 is able to provide knowledge on environmental impacts of non-CO2 emissions as well as knowledge on the practical implementation of mitigation strategies. We can provide this from an operational airport, airline, government policy and ANSP perspective. We look forward to reducing non-CO2 emissions together with the sector.

[2] Airlines divide over new EU rules on monitoring and reporting of their non-CO2 emissions – GreenAir News

[3] Teoh, Roger, et al. “Targeted use of sustainable aviation fuel to maximize climate benefits.” Environmental Science & Technology 56.23 (2022): 17246-17255.

Ream more Articles and News